1. Executive Summary

India’s automotive industry—now the world’s third-largest passenger vehicle market—is undergoing a structural shift, redefining how OEMs design, produce, and scale vehicles. The central strategic tension, termed The Platform Paradox, concerns choosing between:

1) Single-Platform Mass Production (SPMP)

– Historically India’s dominant logic (Maruti 800, Alto, WagonR).

– Focus: ultra-low cost, high volume, minimal complexity.

2) Modular Multi-Energy Platforms (MMEP)

– The emerging global + Indian standard (Tata ALFA/OMEGA, Hyundai K2/EGMP, Mahindra INGLO).

– Focus: flexibility, electrification readiness, variant diversity, digital integration.

Core Finding Across the Report

Modular platforms outperform single platforms across long-term competitiveness, technology integration, regulatory readiness, and multi-segment expansion.

However, a hybrid strategy remains optimal:

- Single-platform mass production → entry hatchbacks, fleet sedans.

- Modular multi-energy platforms → SUVs, EVs, hybrids, MPVs, software-defined vehicles.

Strategic Drivers Behind India’s Platform Shift

| Driver | Impact |

| SUV dominance (>50% share) | High body-style diversity → modular needed |

| Electrification & hybrid surge | Requires multi-energy architectures |

| Regulatory tightening (BS-VI-II, CAFE-II, safety) | Legacy platforms expensive to update |

| Consumer feature expectations | ADAS, OTA, digital cockpits → modular electronics |

| Export ambitions | Global compliance easier with modular platforms |

2. India’s Automotive Market: Key Trends (2024–2035)

India is shifting from a hatchback-driven, cost-first market to a multi-segment, technology-first mobility economy.

2.1 Market Indicators

| Indicator | 2024 Value | 2030–2035 Outlook |

| PV Sales | 4.3–5.1M | 6–7M |

| EV Penetration | 2–8% | 25–30% |

| SUV Share | >50% | 55–60% |

| Industry Value | $240B | $1T by 2035 |

2.2 Structural Market Shift

India’s “small car logic” has collapsed. Two symbolic events capture this change:

Timeline: Rise of SUV Dominance

1990–2015 → Hatchback >60% of market

2019 → SUV >30%

2024 → SUV >50%

2024 → Tata Punch becomes India’s best-selling car (overtaking WagonR)

Conclusion: SUV proliferation has structurally invalidated single-platform strategies.

2.3 Electrification & Hybrid Surge

- BEV CAGR: 30–88%

- Hybrid adoption: Fastest-growing drivetrain in Tier-2/3 markets

- Policy tailwinds: PLI, EV-state incentives, expected FAME successors

Platform implication:

Single platforms cannot accommodate electrified powertrains without costly redesign. Modular platforms are inherently multi-energy capable.

2.4 Regulatory Escalation

Regulatory Complexity Index (2015=100)

2015: 100

2020: 180 (BS-VI + safety)

2023: 220 (RDE, CAFE-II)

2028: 260+ (expected BS-VII)

Regulation increases both engineering cost and platform obsolescence risk.

→ Modular platforms reduce cumulative regulatory upgrade cost.

3. Business Model Canvas: Modular vs. Mass-Scale Strategies

A full BMC across the report has been compressed into a contrast matrix.

3.1 Business Model Canvas Comparison

| BMC Block | Single-Platform Mass Production (SPMP) | Modular Multi-Energy Platforms (MMEP) |

| Key Partners | Component suppliers | Module/system suppliers, software, ADAS |

| Key Activities | Low-variety manufacturing | Scalable architecture design, digital twins |

| Value Proposition | Lowest cost | Variant richness, EV-readiness |

| Customer Segments | Entry-level, fleet | SUV, EV, hybrid, premium, export |

| Channels | Physical sales | Digital retail + connected ecosystems |

| Cost Structure | Low upfront cost | Higher R&D, lower lifecycle cost |

| Revenue Streams | Vehicle sales | Multi-segment sales + software revenue |

4. SWOT Analysis of Platform Strategies

4.1 SWOT Summary Table

| Dimension | SPMP | MMEP |

| Strengths | Lowest cost, simple supply chain | Flexibility, multi-energy, EV-ready |

| Weaknesses | Inflexible, tech-obsolete | High capex, operational complexity |

| Opportunities | Entry-level, fleet exports | SUVs, hybrids, EVs, global markets |

| Threats | EV disruption, regulation, SUV boom | Chinese EV imports, high supplier dependence |

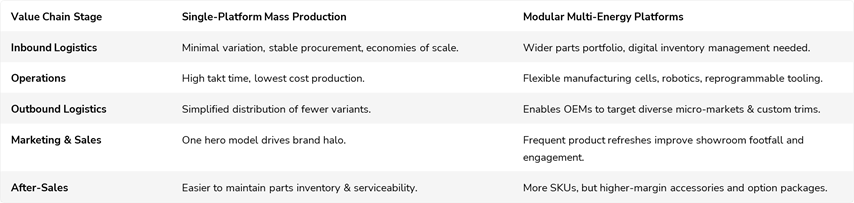

5. Value Chain Analysis (Operations Strategy)

6. Core & Distinctive Competencies

6.1 Core Competencies (Both Strategies)

- Supplier management

- Cost engineering

- Quality control

- Regulatory compliance

6.2 Distinctive Competencies (Modular Required)

| Distinctive Competency | Why It Matters |

| Modular architecture engineering | Multi-segment scalability |

| SDV software stack | OTA, ADAS, digital cockpit |

| EV powertrain & battery systems | Regulatory & market inevitability |

| Digital twins & simulation | Faster development |

| Platform portfolio management | Multi-brand, multi-variant coherence |

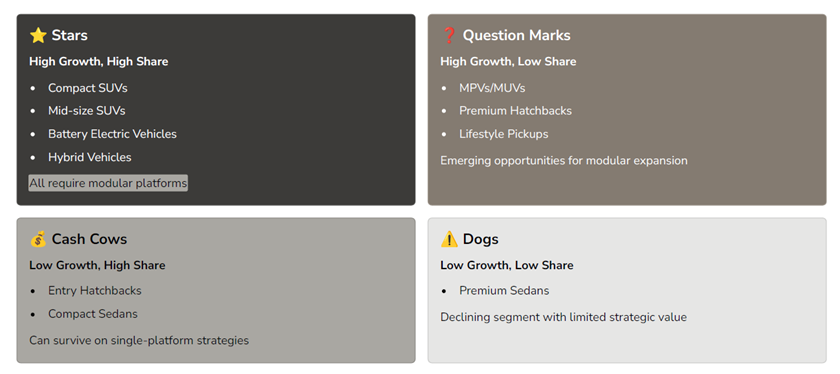

7. BCG Matrix for India’s Segments (2024–2030)

7.1 Segment Quadrant Mapping

BCG MATRIX (India PV Market 2024–2030)

Strategic Implication

All Star segments require modular architectures.

All Cash Cow segments can survive on SPMP.

8. Porter’s Five Forces: Impact on Platform Strategy

8.1 Summary Table

| Porter Force | SPMP Impact | MMEP Impact | Strategic Winner |

| Rivalry | Weak responsiveness | Strong responsiveness | MMEP |

| Substitutes (EV, hybrids) | Highly vulnerable | Flexible | MMEP |

| Buyer Power | Weak feature flexibility | Strong feature variety | MMEP |

| Supplier Power | Low-tech suppliers | Dependence on ADAS/battery suppliers | Balanced |

| New Entrants (EV OEMs) | Obsolete | Competitive | MMEP |

Result: 4 out of 5 forces favor modular platforms.

9. PESTEL Analysis

Political

Support for EVs, PLI schemes → modular favored.

Economic

Rising incomes → demand for technology & variety → modular.

Social

Aspirational identity + safety awareness → modular needed.

Technological

SDVs, OTA, ADAS → require modular electronics.

Environmental

EV adoption → multi-energy platforms required.

Legal

Emissions + safety norms → frequent redesign → modular reduces cost.

10. Competitive Benchmarking (OEM-by-OEM)

| OEM | Current Platform Maturity | Strengths | Weaknesses |

| Maruti Suzuki | Low modularity | Cost leadership | No EV platform, SUV vulnerability |

| Hyundai–Kia | Very high | Global modular systems | Higher cost base |

| Tata Motors | High (ALFA, OMEGA, Acti.ev) | EV leadership | Software refinement |

| Mahindra | High (INGLO) | SUV dominance | Lower scale |

| VW–Skoda | High (MQB-A0-IN) | Safety, tech | Price positioning |

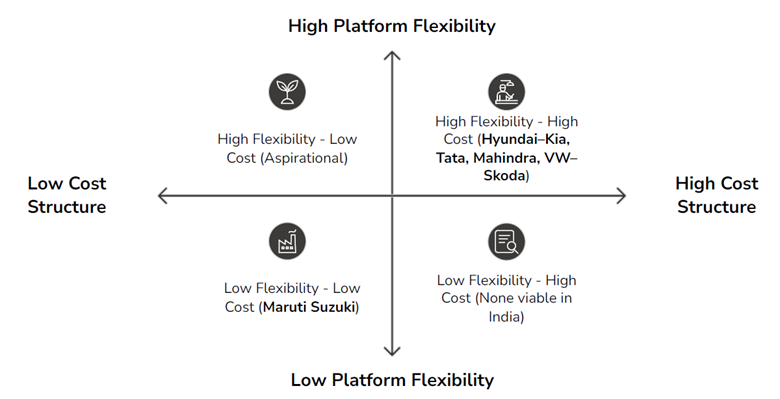

11. Positioning Map: Flexibility vs. Cost

Insight:

Maruti sits alone in the low-cost/low-flexibility quadrant—unsustainable as SUVs and EVs dominate.

12. Key Success Factors (2025–2035)

- Multi-energy modular platforms (BEV, HEV, ICE)

- Software-defined vehicle architecture

- ADAS integration capability

- Multi-segment portfolio agility

- Supplier co-creation & localization of modules

- OTA-based lifecycle monetization

13. Differentiation Theory: Why Modular Wins

Differentiation Levers in Automotive (2025–2035)

Mechanical Engineering Importance: 70% → 30%

Software, Electronics, Experience: 30% → 70%

Modularity aligns with future differentiation; SPMP does not.

14. Strategic Conclusions

- Modular architectures are not optional—they are strategic imperatives.

- Single platforms remain viable only in entry-level, low-growth segments.

- India’s profit pools are shifting to segments that require modularity.

- EV and hybrid acceleration will make SPMP architectures economically obsolete.

- OEM competitiveness depends on software + modular hardware convergence.

- India’s GVC ambitions require export-ready modular platforms.

15. Recommendations

15.1 For OEMs

Short-Term

- Migrate 60–80% of future models to 2–3 modular platforms.

- Standardize hardpoints and electrical architecture.

- Integrate digital twin capabilities.

Medium-Term

- Build native EV skateboard platforms.

- Localize e-axles, BMS, thermal systems.

- Establish ADAS calibration infrastructure network-wide.

Long-Term

- Transition to full SDV architecture with zonal controllers.

- Monetize OTA and feature-on-demand models.

15.2 For Policymakers

- Accelerate domestic semiconductor and battery supply chain.

- Expand incentives for modular platform localization.

- Support EV/Hybrid multi-energy production through harmonized standards.

15.3 For Investors

- Prioritize OEMs with modular platform maturity.

- Invest in Tier-1 suppliers evolving into module/system integrators.

- Focus on software, telematics, and ADAS ecosystems as multi-year growth areas.

16. Final Verdict

From the combined technical, economic, regulatory, and competitive analyses:

✔ Modular Multi-Energy Platforms are the structural winners of India’s automotive future.

✔ SPMP will survive only in shrinking low-cost niches.

✔ OEMs that fail to migrate to modular architectures risk long-term irrelevance.

India’s automotive renaissance is fundamentally a platform transformation revolution.

The winners will be those who treat the vehicle as:

- A modular hardware system,

- A software ecosystem, and

- A scalable platform for multi-segment expansion.