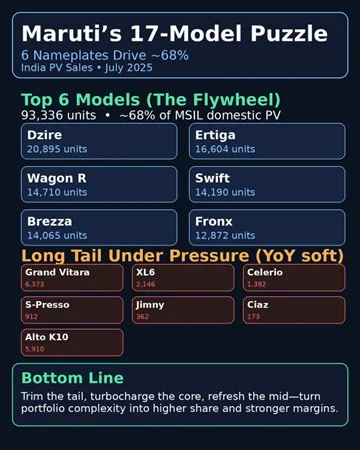

India’s #1 Maruti Suzuki India Limited has 17 nameplates (models), yet only six are powering roughly two-thirds of the story, while seven are sharply down year-on-year (July’2025 domestic PV sales). That isn’t just a sales mix quirk; it’s a strategy tax: overlapping bodies, variant sprawl, diluted marketing, and slower dealer turns.

❓ 𝗪𝗵𝘆 𝘁𝗵𝗲 𝗹𝗼𝗻𝗴 𝘁𝗮𝗶𝗹 𝗲𝘅𝗶𝘀𝘁𝘀 (𝗮𝗻𝗱 𝘄𝗵𝘆 𝗶𝘁 𝗯𝗶𝘁𝗲𝘀):

➖ 𝙎𝙝𝙚𝙡𝙛-𝙨𝙥𝙖𝙘𝙚 𝙘𝙤𝙫𝙚𝙧𝙖𝙜𝙚 & 𝙥𝙧𝙞𝙘𝙚 𝙡𝙖𝙙𝙙𝙚𝙧𝙨 across dual channels to catch every buyer.

➖ 𝙍𝙚𝙜𝙪𝙡𝙖𝙩𝙤𝙧𝙮/𝙢𝙞𝙭 𝙝𝙚𝙙𝙜𝙞𝙣𝙜 (small/CNG to offset bigger SUVs for fleet efficiency).

➖ 𝙀𝙭𝙥𝙤𝙧𝙩 & 𝙘𝙧𝙤𝙨𝙨-𝙊𝙀𝙈 𝙥𝙞𝙥𝙚𝙡𝙞𝙣𝙚𝙨 that prefer a broad menu.

But breadth without clear roles becomes 𝙞𝙣𝙩𝙚𝙧𝙣𝙖𝙡 𝙘𝙖𝙣𝙣𝙞𝙗𝙖𝙡𝙞𝙯𝙖𝙩𝙞𝙤𝙣, especially in micro-hatches and compact people movers, while mid-SUVs need faster tech/value moves.

🥓 𝗪𝗵𝗮𝘁’𝘀 𝗿𝗲𝗮𝗹𝗹𝘆 𝗯𝗿𝗲𝗮𝗸𝗶𝗻𝗴:

➡️ 𝙐𝙣𝙙𝙚𝙧-𝙙𝙞𝙛𝙛𝙚𝙧𝙚𝙣𝙩𝙞𝙖𝙩𝙚𝙙, 𝙖𝙜𝙞𝙣𝙜 𝙣𝙖𝙢𝙚𝙥𝙡𝙖𝙩𝙚𝙨 in segments the market is leaving behind.

➡️ 𝙑𝙖𝙧𝙞𝙖𝙣𝙩 𝙤𝙫𝙚𝙧𝙡𝙤𝙖𝙙 that confuses buyers and fragments ad spend.

➡️ 𝙁𝙚𝙖𝙩𝙪𝙧𝙚 𝙜𝙖𝙥 vs refreshed rivals (think ADAS, connected tech, hybrid value).

➡️ 𝘾𝙝𝙖𝙣𝙣𝙚𝙡 𝙙𝙪𝙥𝙡𝙞𝙘𝙖𝙩𝙞𝙤𝙣 that muddies Arena vs premium (Nexa) positioning.

𝗧𝗵𝗲 𝗽𝗹𝗮𝘆𝗯𝗼𝗼𝗸 (𝟭𝟮–𝟭𝟰 𝗺𝗼𝗱𝗲𝗹𝘀, 𝗵𝗶𝗴𝗵𝗲𝗿 𝘁𝗵𝗿𝗼𝘂𝗴𝗵𝗽𝘂𝘁)

1️⃣ 𝙋𝙧𝙪𝙣𝙚 & 𝙢𝙚𝙧𝙜𝙚 𝙬𝙞𝙩𝙝 𝙞𝙣𝙩𝙚𝙣𝙩

Retire the weakest micro-hatch, fold premium trims into the mainstream MPV, and sunset the legacy sedan. Keep one ultra-efficient entry car (incl. CNG) for fleet/rural; stop proliferating SKUs.

2️⃣ 𝙁𝙞𝙭 𝙩𝙝𝙚 𝙢𝙞𝙙, 𝙛𝙖𝙨𝙩

Add ADAS, tighten hybrid total cost of ownership (EMI-friendly finance), and consider a 3-row derivative where family buyers are migrating.

3️⃣ 𝙋𝙪𝙩 𝙣𝙞𝙘𝙝𝙚 𝙩𝙤 𝙬𝙤𝙧𝙠

Recast the lifestyle off-roader as limited-run halo with accessories/community; make exports-first the profit center rather than chasing scale domestically.

4️⃣ 𝙑𝙖𝙧𝙞𝙖𝙣𝙩 & 𝙘𝙝𝙖𝙣𝙣𝙚𝙡 𝙙𝙞𝙨𝙘𝙞𝙥𝙡𝙞𝙣𝙚

Cap each nameplate at 8–10 selling variants with clear price steps. Clarify channels: value/fleet on one side; premium/tech & hybrids on the other.

5️⃣ 𝙃𝙖𝙧𝙙 𝙜𝙖𝙩𝙚𝙨, 𝙣𝙤 𝙚𝙭𝙘𝙚𝙥𝙩𝙞𝙤𝙣𝙨

Any model must deliver ≥4,000 units/month or ≥6% model-level EBIT (rolling 12 months). Miss two consecutive quarters → cull or merge.

𝗡𝗲𝘅𝘁 𝗠𝗼𝘃𝗲𝘀

𝙏𝙧𝙞𝙢 𝙩𝙝𝙚 𝙩𝙖𝙞𝙡 → 𝙩𝙪𝙧𝙗𝙤𝙘𝙝𝙖𝙧𝙜𝙚 𝙩𝙝𝙚 𝙘𝙤𝙧𝙚 → 𝙧𝙚𝙛𝙧𝙚𝙨𝙝 𝙩𝙝𝙚 𝙢𝙞𝙙

Turn portfolio complexity into share + margin, and convert “coverage” into clear choices customers can feel—in features, finance, and ownership value.