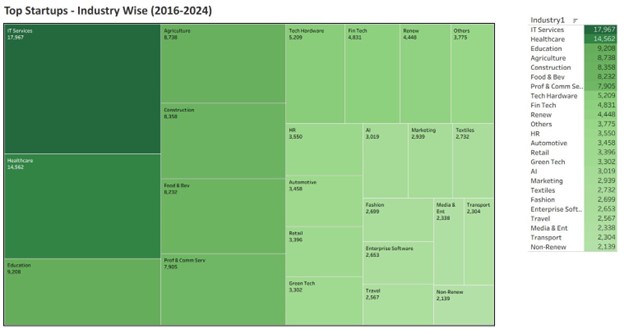

🏭 INDUSTRIES – Who Ruled 2016-24?

➡️ IT Services (~18 k recognitions): Low cap-ex entry, vast talent pool, global digital demand.

➡️ Healthcare & Life-sciences (~14.6 k): Tele-health boom, med-tech innovation, pandemic tailwinds.

➡️ Education Tech (~9.2 k): NEP-2020, vernacular apps, remote-learning surge.

➡️ Agritech (~8.7 k): FPO reforms, climate-smart farming, UPI-enabled rural commerce.

➡️ Construction / Infra-tech (~8.4 k): Smart-city missions and record public cap-ex drive prop-tech & green-cement challengers.

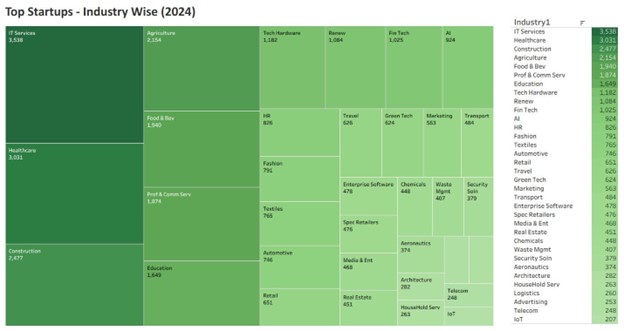

🔍 2024 Snapshot – Momentum Shifts

➡️ IT Services still #1 (3.5 k new recognitions) but its share dips as capital pivots to hard-tech.

➡️ Construction / Infra-tech rockets to #3 (2.5 k) on the back of PM Gati Shakti and urban-infra pipelines.

➡️ AI, Green-tech, Waste-management, Security-solutions crack the top-20 for the first time as deep-tech niches go commercial.

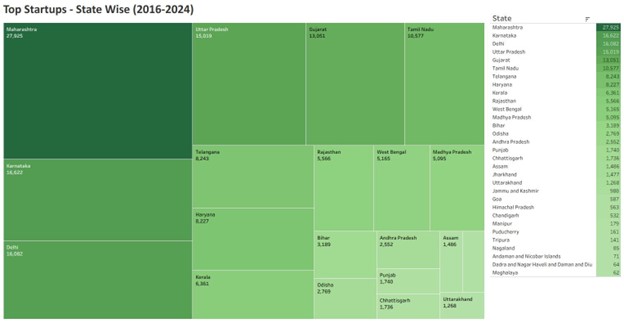

🗺️ STATES – Where Founders Clustered (2016-24)

➡️ Maharashtra (~28 k): Mumbai-Pune VC density, corporate customers, fintech & media hubs.

➡️ Karnataka (~16.6 k): Bengaluru’s SaaS brain-trust and deep-tech academia.

➡️ Delhi-NCR (~16 k): Policy corridor, D2C brands, quick-commerce experimentation.

➡️ Uttar Pradesh (~15 k): Startup Policy 2.0, Jewar airport, defence corridor creating fresh pull.

➡️ Gujarat (~13 k): GIFT City, Vibrant Gujarat, renewable & semiconductor bets.

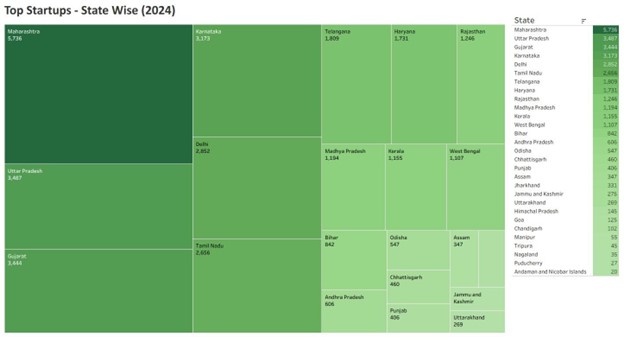

🔍 2024 State Leaderboard – Changing Guard

➡️ Maharashtra (5.7 k) stays king but growth is steadier than explosive.

➡️ Uttar Pradesh (3.5 k) jumps to #2 on the back of mega-infra and policy sweeteners.

➡️ Gujarat (3.4 k) claims #3 as GIFT City’s tax breaks and the semicon mission lure founders.

➡️ 58 % of 2024 recognitions now come from Tier-II/III towns – startup energy is decentralising fast.

🔮 2025-30 – Signals to Watch

💡 Climate-tech & Renewables poised to outpace pure-play SaaS as the ₹20 k cr Green Hydrogen Mission scales.

💡 AI, Semicon & Space-tech will thrive on PLI schemes and IN-SPACe reforms – think lab-to-orbit.

💡 Capital flows: smaller rounds, saner valuations, more domestic dry-powder via AIFs & GIFT-IFSC.

💡 Jobs multiplier: 1.76 mn direct jobs so far; doubling recognitions could push formal job creation past 4 mn by 2030 at today’s ~11-jobs-per-startup ratio.

💡 Policy tailwinds: ONDC + OCEN + Startup India 2.0 slash go-to-market friction for MSME-focused ventures.

📈 Net-Net: A Positive Arc for India?

🔔 Yes. More startups → deeper innovation GDP → stronger formal SME base → higher-quality employment.

🔔 Headwinds (funding winter, exit pathways, advanced-skills gap) are real, yet the trajectory remains solidly north-east.

💡 Your Turn: Which sector or state are you betting on for the next five years? Drop your thoughts below 👇