Executive Summary (C-Level Ready)

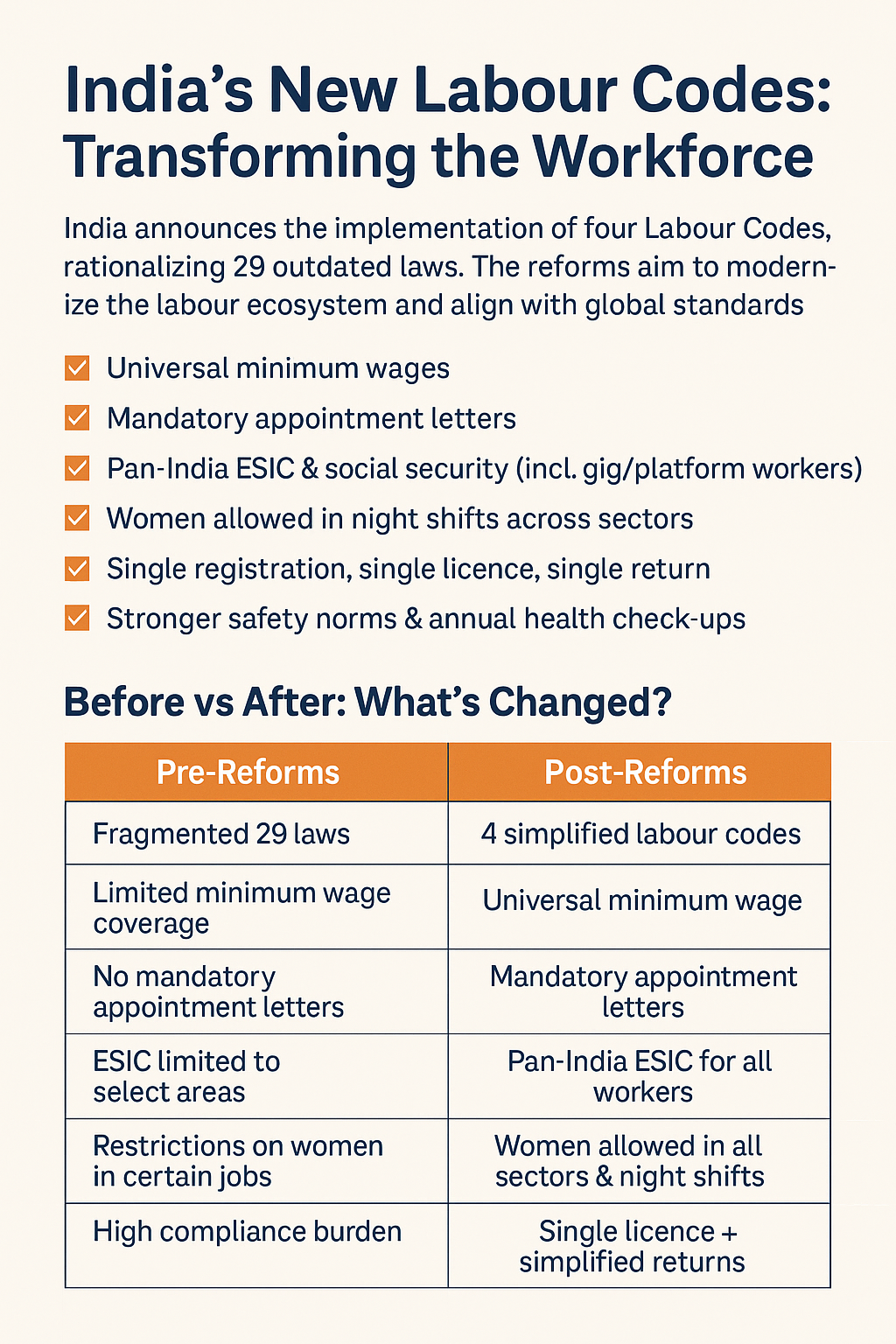

The Government of India has implemented four consolidated Labour Codes—Wages (2019), Industrial Relations (2020), Social Security (2020), and OSHWC (2020)—effective 21 Nov 2025, replacing 29 fragmented labour laws. This overhaul aims to modernise India’s labour market, expand social protection, and reduce compliance complexity, strengthening India’s competitiveness and supporting Aatmanirbhar Bharat.

Key strategic shifts include mandatory appointment letters, universal minimum wages, pan-India ESIC coverage, gender-neutral opportunities, portability of benefits, and single registration/returns systems.

Key Insights & Structural Changes

1. Formalisation of Employment

- Mandatory appointment letters for all workers → transparency & structured employment.

2. Universal Social Security

- Gig/platform workers included for the first time.

- PF, ESIC, insurance benefits extended across worker categories.

- Aggregators must contribute 1–2% of turnover toward welfare funds.

3. Wage Protection & Floor Wages

- Minimum wages now apply to all workers, not just scheduled industries.

- Mandatory timely wage payment; floor wage determined nationally.

4. Occupational Safety & Health

- Employers must provide free annual health check-ups for workers over 40.

- National OSH Board to standardise safety norms.

- Safety committees mandatory for large establishments (500+).

5. Simplified Compliance

- Single licence, single registration, and single return replace multiple filings.

- Inspector-cum-Facilitator system shifts enforcement toward guidance rather than punishment.

Emerging Trends

1. Rise of Formal & Flexible Work Models

- Greater adoption of fixed-term employment with parity to permanent staff.

- Decline in excessive contractualisation; preference for direct hiring.

2. Inclusion of Gig, Platform & Digital Workforce

- First-time recognition of gig/platform work → structural shift in labour governance.

- Portability of benefits will reshape India’s informal labour market.

3. Increased Female Labour Participation

- Women allowed in night shifts and hazardous sectors with safety protocols.

- Gender-neutral pay mandated.

4. Safety- and Health-Centric Workplaces

- Mandatory health checks, safety committees, national OSH standards.

- Particularly critical for mining, hazardous processing, plantations, export zones.

5. Social Protection as an Industrial Policy Lever

- Social security coverage scaled from 19% (2015) to 64% (2025); codes accelerate this further.

Sector-Wise Analysis

Below is a strategic breakdown across key sectors as described in the report.

1. MSMEs

Opportunities

- Reduced compliance → easier formalisation.

- Standard work hours, paid leave, and timely wages improve worker productivity.

Risks

- Increased cost of benefits (ESIC, PF, facilities).

2. Gig & Platform Economy

Opportunities

- Recognition strengthens legitimacy of platforms.

- Welfare fund contributions create sustainable social protection.

Risks

- Increased cost burden on aggregators; may reduce contractor flexibility.

3. Manufacturing (Textiles, Hazardous Industries, Mines)

Improvements

- Safety norms strengthened; women allowed in high-paying roles.

- Mandatory PPE & training; double wages for overtime.

Risks

- Higher compliance and safety costs.

4. IT & ITES

Benefits

- Wage transparency, equal pay, and grievance redressal strengthen workforce trust.

- Women allowed in night shifts will expand the talent pool.

Risks

- Stricter wage timelines may affect cash-flow-heavy startups.

5. Export Sector

Benefits

- Higher compliance likely improves global competitiveness.

- Formalisation and worker safeguards align with ESG expectations.

Risks

- Additional cost of night-shift safety measures, overtime, and benefits.

SWOT Analysis (Cross-Sectoral)

Strengths

- Universal social security net.

- Simplified compliance → ease of doing business.

- Gender equality and inclusion norms enforced.

- Modernised labour framework aligned with global standards.

Weaknesses

- Implementation challenges for MSMEs.

- Transition complexity across 29 repealed laws.

- Cost of compliance (ESIC, safety, benefits) rises for employers.

Opportunities

- Boost in formalisation and productivity.

- Investment attractiveness increases due to regulatory clarity.

- Expanded workforce participation (women, youth, gig workers).

- Healthier and safer workplaces reduce long-term costs.

Threats

- Short-term disruption due to rule harmonisation.

- Possible resistance from industry during transition.

- Gig platforms may pass welfare costs to customers, impacting growth.

Strategic Recommendations

For Policymakers

- Phased implementation roadmap with industry-specific guidelines.

- Digital compliance infrastructure to support single registration & returns.

- Awareness campaigns for gig workers, MSMEs, and migrant workers to drive enrolment.

- Incentivise early adoption (rebates, ESIC contribution support for MSMEs).

For Industry Leaders

- Conduct readiness audits

- Wage structure review

- ESIC/PF applicability mapping

- Night-shift safety compliance (for women)

- Redesign workforce models

- Shift from contract-heavy to fixed-term employment.

- Develop benefit frameworks for gig and platform workers.

- Digital HR systems

- Appointment letter automation

- Wage payment monitoring

- UAN and Aadhaar-based employee lifecycle management

- Strengthen safety & health infrastructure

- Annual health checks

- PPE, OSH committees

- Hazard management protocols

For Investors

- Favour companies with strong compliance maturity—lower future operational risk.

- Monitor platform companies for cost impact from welfare contributions.

- Identify sectors gaining from talent expansion & formalisation—IT, textiles, manufacturing.