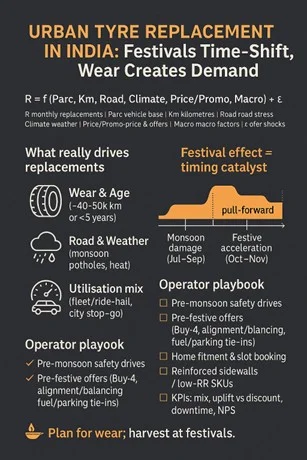

Hook: Are city tyre replacements directly proportional to the festive season? 𝙎𝙝𝙤𝙧𝙩 𝙖𝙣𝙨𝙬𝙚𝙧: 𝙉𝙤. Festivals act as a catalyst, not the core cause. Wear, age, and usage remain the real drivers.

𝗪𝗵𝗮𝘁 𝗿𝗲𝗮𝗹𝗹𝘆 𝗺𝗼𝘃𝗲𝘀 𝘁𝗵𝗲 𝗻𝗲𝗲𝗱𝗹𝗲

➖ Wear & age > festivals: Most replacements happen at ~40–50k (km) or ~5 years (whichever comes first), amplified by alignment/pressure issues and stop-go city driving.

➖ Road & weather stress: Monsoon potholes and heat trigger unplanned sidewall and tread damage—outside any festive cadence.

➖ Utilization mix: Fleet/ride-hail vehicles refresh faster on total cost of ownership (TCO) math, not holiday calendars.

➖ Festive impact: Navratri–Diwali boosts timing via pre-journey checks and promotions, pulling some demand forward by a few weeks. The baseline is still wear-driven.

A simple demand lens (urban)

𝑹 = 𝒇(𝑷𝒂𝒓𝒄, 𝑲𝒎 𝒅𝒓𝒊𝒗𝒆𝒏, 𝑹𝒐𝒂𝒅 𝒔𝒕𝒓𝒆𝒔𝒔, 𝑪𝒍𝒊𝒎𝒂𝒕𝒆/𝑾𝒆𝒂𝒕𝒉𝒆𝒓, 𝑷𝒓𝒊𝒄𝒆/𝑷𝒓𝒐𝒎𝒐, 𝑴𝒂𝒄𝒓𝒐) + 𝑫_𝒇𝒆𝒔𝒕𝒊𝒗𝒆 + ε

R = monthly urban replacements | Parc = vehicle base | D_festive = festival window | ε = other shocks

Expect D_festive > 0 but smaller than Km and Road/Climate—it shifts when buyers convert more than how much they buy.

𝗪𝗵𝗮𝘁 𝘁𝗵𝗶𝘀 𝗺𝗲𝗮𝗻𝘀 𝗳𝗼𝗿 𝗼𝗽𝗲𝗿𝗮𝘁𝗼𝗿𝘀 & 𝗺𝗮𝗿𝗸𝗲𝘁𝗲𝗿𝘀

🎯 Plan two waves: (1) Pre-monsoon safety (tread checks, alignment/balancing bundles) (2) Pre-festive acceleration (Buy-4 offers, fuel/parking tie-ins, home fitment slots).

🧱 Product/portfolio: Reinforced sidewalls for city corridors; low-rolling-resistance stock-keeping units (SKUs) for commuters; durability lines for fleets.

🧩 Channels & user experience (UX): Transparent pricing, slot booking, mobile vans for Resident Welfare Associations (RWAs) and office parks; retarget festive deal seekers.

🤝 Partnerships: Fuel brands, parking apps, OEM service centers for out-of-warranty vehicles.

📊 Operate by KPIs: Sell-out mix, discount depth vs uplift, downtime guarantees, Net Promoter Score (NPS) post-fitment, claim rates (sidewall/pothole).

𝗨𝗿𝗯𝗮𝗻 𝗻𝘂𝗮𝗻𝗰𝗲 𝘁𝗼 𝗿𝗲𝗺𝗲𝗺𝗯𝗲𝗿

➡️ Festive weeks = higher workshop footfalls, but peaks often follow monsoon damage.

➡️ Expect normalization after the festive window as pulled-forward demand settles.

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

Festivals don’t create tyre demand in cities—they focus and accelerate it. Build forecasts and inventory on wear/age and road-stress fundamentals, then use the festive window to harvest conversions, capture share, and improve mix.