Independent Directors (IDs) are often called the custodians of governance. But what if I told you their role is not just about oversight—it’s becoming 𝗰𝗲𝗻𝘁𝗿𝗮𝗹 𝘁𝗼 𝘀𝗵𝗮𝗽𝗶𝗻𝗴 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝘆, 𝗱𝗿𝗶𝘃𝗶𝗻𝗴 𝗮𝗰𝗰𝗼𝘂𝗻𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆, 𝗮𝗻𝗱 𝘀𝘁𝗲𝗲𝗿𝗶𝗻𝗴 𝘁𝗵𝗲 𝗳𝘂𝘁𝘂𝗿𝗲 𝗼𝗳 𝗰𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲 𝗜𝗻𝗱𝗶𝗮?

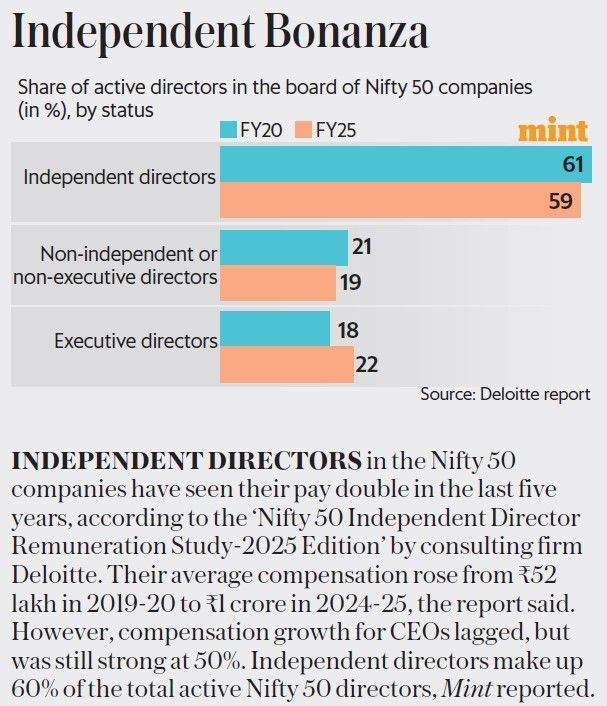

A recent Deloitte study on Nifty 50 companies (FY20–FY25) reveals some powerful shifts:

▪️ 𝗖𝗼𝗺𝗽𝗲𝗻𝘀𝗮𝘁𝗶𝗼𝗻 𝗗𝗼𝘂𝗯𝗹𝗲𝗱 – Average remuneration rose from ₹52 lakh in FY20 to ₹1 crore in FY25. A 100% jump in just five years.

▪️ 𝗣𝗲𝗿𝗳𝗼𝗿𝗺𝗮𝗻𝗰𝗲-𝗟𝗶𝗻𝗸𝗲𝗱 𝗣𝗮𝘆 – Commissions (tied to profitability) and higher sitting fees (due to more meetings) are driving growth.

▪️ 𝗦𝘁𝗿𝗼𝗻𝗴𝗲𝗿 𝗣𝗿𝗲𝘀𝗲𝗻𝗰𝗲 𝗼𝗻 𝗕𝗼𝗮𝗿𝗱𝘀 – Independent directors now make up ~61% of Nifty 50 boards, up from 59% in FY20.

▪️ 𝗪𝗼𝗺𝗲𝗻 𝗥𝗶𝘀𝗶𝗻𝗴 – Women’s board representation increased from 18% (FY19) to 22% (FY24). Their compensation doubled, outpacing male peers.

▪️ 𝗖𝗼𝗺𝗺𝗶𝘁𝘁𝗲𝗲 𝗣𝗼𝘄𝗲𝗿 – Women directors now handle more committees on average (~3 vs ~2 earlier), narrowing the influence gap.

▪️ 𝗖𝗘𝗢 𝘃𝘀. 𝗜𝗗 𝗚𝗿𝗼𝘄𝘁𝗵 – While CEO pay grew ~50% in the same period (median ₹10 crore), IDs saw faster relative growth—though at much lower absolute levels.

𝗪𝗵𝗮𝘁 𝗗𝗼𝗲𝘀 𝗧𝗵𝗶𝘀 𝗠𝗲𝗮𝗻?

▪️ Companies are 𝗶𝗻𝘃𝗲𝘀𝘁𝗶𝗻𝗴 𝗶𝗻 𝘀𝘁𝗿𝗼𝗻𝗴𝗲𝗿 𝗴𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲—not just compliance.

▪️ Independent Directors are evolving from 𝑤𝑎𝑡𝑐ℎ𝑑𝑜𝑔𝑠 to 𝘀𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗰 𝗶𝗻𝗳𝗹𝘂𝗲𝗻𝗰𝗲𝗿𝘀.

▪️ Gender inclusion is 𝗺𝗼𝘃𝗶𝗻𝗴 𝗯𝗲𝘆𝗼𝗻𝗱 𝗿𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗼𝗻 towards real impact, though more work remains.

▪️ For investors, stronger performance-linked ID compensation builds 𝘁𝗿𝘂𝘀𝘁 𝗮𝗻𝗱 𝗰𝗼𝗻𝗳𝗶𝗱𝗲𝗻𝗰𝗲.

▪️ For aspiring leaders, opportunities in boardrooms are 𝗲𝘅𝗽𝗮𝗻𝗱𝗶𝗻𝗴 𝗳𝗮𝘀𝘁𝗲𝗿 𝘁𝗵𝗮𝗻 𝗲𝘃𝗲𝗿.

𝗧𝗵𝗲 𝗥𝗼𝗮𝗱 𝗔𝗵𝗲𝗮𝗱

The challenge is to 𝗯𝗮𝗹𝗮𝗻𝗰𝗲 𝗳𝗮𝗶𝗿 𝗽𝗮𝘆 𝘄𝗶𝘁𝗵 𝗶𝗻𝗱𝗲𝗽𝗲𝗻𝗱𝗲𝗻𝗰𝗲. Too much financial linkage risks compromising autonomy. At the same time, transparent disclosures, global benchmarking, and more inclusive board policies can ensure IDs remain the 𝗽𝗶𝗹𝗹𝗮𝗿𝘀 𝗼𝗳 𝗮𝗰𝗰𝗼𝘂𝗻𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 in India’s corporate growth story.

Independent Directors are no longer in the shadows—they are emerging as 𝘁𝗵𝗲 𝘀𝗶𝗹𝗲𝗻𝘁 𝗴𝗮𝗺𝗲-𝗰𝗵𝗮𝗻𝗴𝗲𝗿𝘀 𝗼𝗳 𝗜𝗻𝗱𝗶𝗮 𝗜𝗻𝗰.