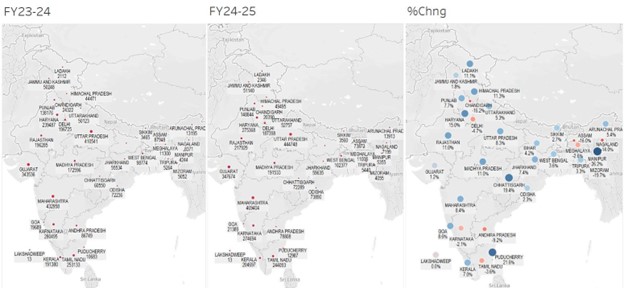

India’s four-wheeler (LMV) market is showing distinct regional patterns of growth and decline in FY24-25. Here’s a snapshot of insights from transport registration data (Vahan):

🔝 Top 5 Growth States:

Manipur: ⬆️ 26.2%

Puducherry: ⬆️ 21.6%

DNH & Daman-Diu (UT): ⬆️ 20.9%

Chhattisgarh: ⬆️ 19.4%

Haryana: ⬆️ 15.0%

📉 Top 5 Decline States:

Mizoram: ⬇️ 19.7%

Chandigarh: ⬇️ 16.2%

Assam: ⬇️ 15.9%

Nagaland: ⬇️ 14.0%

Andhra Pradesh: ⬇️ 9.1%

🏆 Volume Leaders (FY24-25):

Maharashtra: 4.69L

Uttar Pradesh: 4.44L

Gujarat: 3.47L

Haryana: 2.75L

Karnataka: 2.74L

📊 Strategic Observations:

📌 Strong double-digit growth in smaller states/UTs signals rural penetration and increased mobility access.

📌 Northern states like Haryana and Chhattisgarh are leading the charge in volume and growth—likely benefiting from infrastructure and income uptick.

📌 Declines in northeastern states and Andhra Pradesh highlight demand disparities needing localized strategies.

🔍 For auto OEMs, financiers, and mobility enablers—understanding micro-markets will be key in FY25-26. The Indian market is evolving fast—but not uniformly.

👉 Curious to know how your region performed?