Why Ola Is Losing Share & Seeing Declining Revenue?

1️⃣ Execution Gaps: Quality hiccups and delivery delays cut Q4 volumes by over 50%.

2️⃣ Competitive Edge: Legacy OEM’s (Bajaj Auto Ltd, TVS Motor Company, Hero MotoCorp) leverage deep networks and aggressive pricing; startups (Ather Energy, Okinawa Autotech, Ampere, PuREEnergy India) drive innovation and agile execution.

3️⃣ Service Lapses: Limited touchpoints and slow repairs erode trust.

4️⃣ Regulatory Overhang: SEBI probes on data and subsidy claims dent confidence.

Key Challenges Faced by Ola

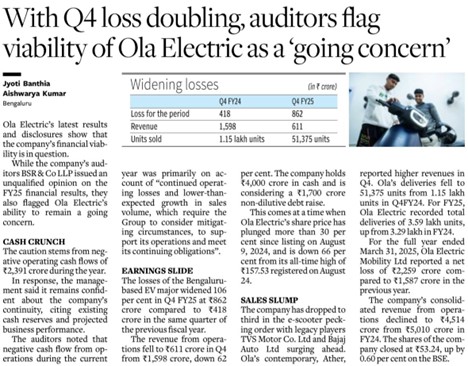

1️⃣ Cash Burn: Heavy capex on cell manufacturing with limited sales revenue.

2️⃣ Quality at Scale: Rapid ramp-up outpaces robust QC processes.

3️⃣ Limited Reach: Nano-dealer model trails legacy OEMs’ 5,000+ outlets.

4️⃣ Brand Perception: Leadership controversies and missed timelines.

5️⃣ Compliance Risks: Ongoing subsidy and disclosure investigations

Strategic Recommendations for Turnaround

1️⃣ Cost & Capex: Shift non-critical spend to contract manufacturing; optimize Gen-3 platform.

2️⃣ Go-to-Market: Build hybrid dealer-service hubs in Tier 2/3; expand BNPL/EV loans.

3️⃣ After-Sales: Deploy mobile service vans; incentivize fast turnaround.

4️⃣ Trust Rebuild: Publish delivery and quality metrics; share customer success stories.

Path to Profitability & Growth Drivers

1️⃣ Focus on Core Scooter Business: Defer non-urgent cell manufacturing investments until scooters achieve cash-positive status.

2️⃣ Monetize Digital Services: Launch tiered subscriptions for ride analytics, predictive maintenance and usage-based insurance.

3️⃣ Expand Tier 2/3 Penetration: Introduce budget-friendly “Ola One” variant and flexible financing plans for price-sensitive customers.

4️⃣ Forge Strategic Alliances: Collaborate with fleet operators, delivery aggregators and battery-swap networks to drive utilization and recurring revenues.

By executing on these strategic levers—cost discipline, market reach, service excellence and digital monetization—Ola Electric can arrest share erosion, stabilize revenues and steer toward sustainable profitability in FY 2026 and beyond. Let’s accelerate India’s green mobility revolution together! 🌱⚡