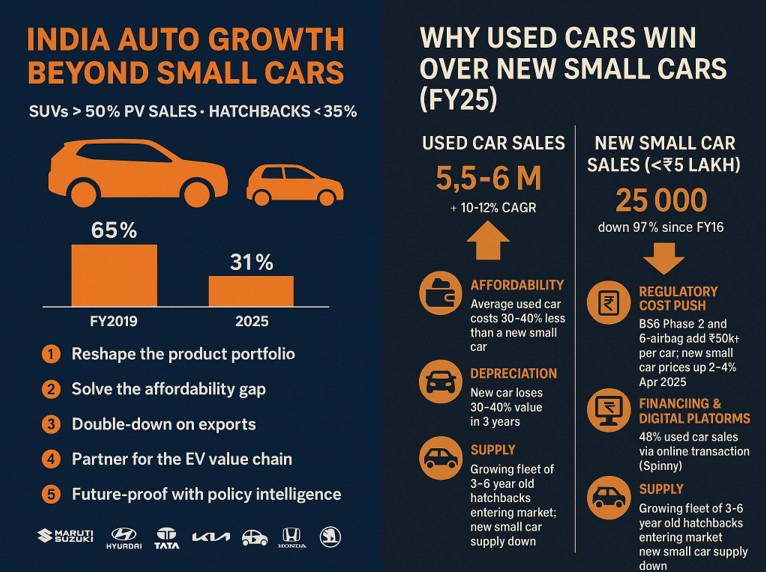

India’s passenger-vehicle (PV) sales have doubled in a decade—but the mix has flipped. Hatchbacks now hold barely ⅓ of PV share, while SUVs capture > 50 % of new demand. Asking the small-car segment to grow 8-10 % every year is a risky single-point strategy. Here’s how OEMs Maruti Suzuki India Limited, Hyundai Motor India Ltd., Tata Motors (and their suppliers) can stay on the front foot:

1️⃣ 𝗥𝗲-𝘀𝗵𝗮𝗽𝗲 𝘁𝗵𝗲 𝗽𝗿𝗼𝗱𝘂𝗰𝘁 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼

💡 Compact & entry SUVs – Re-use small-car platforms to create taller, aspirational crossovers that still meet tight parking and tax constraints.

💡 City-EV play – Launch sub-4 m electric runabouts only once battery costs hit the ₹8 kWh sweet spot—until then, lead with higher-margin e-SUVs.

2️⃣ 𝗦𝗼𝗹𝘃𝗲 𝘁𝗵𝗲 𝗮𝗳𝗳𝗼𝗿𝗱𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗴𝗮𝗽

💡 “Frugal premium” design—simplify trims, use modular dashboards, and offer software-locked features (pay-later upgrades) to keep sticker prices under ₹7 lakh.

💡 Subscription & used-car tie-ins that let first-time buyers sample ownership without a full down-payment hit.

3️⃣ 𝗗𝗼𝘂𝗯𝗹𝗲-𝗱𝗼𝘄𝗻 𝗼𝗻 𝗲𝘅𝗽𝗼𝗿𝘁𝘀 & 𝗖𝗞𝗗 𝗿𝗼𝘂𝘁𝗲𝘀

💡 Treat India as a global small-car hub—volume stability comes from shipping to Africa, LatAm, and ASEAN even when domestic demand stalls.

💡 Leverage CKD/SKD kits to side-step tariff walls and nurture local assembly partnerships abroad.

4️⃣ 𝗣𝗮𝗿𝘁𝗻𝗲𝗿 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗘𝗩 𝘃𝗮𝗹𝘂𝗲 𝗰𝗵𝗮𝗶𝗻

💡 Secure cell-to-pack alliances with LFP/LMFP suppliers; hedge raw-material risk early.

💡 Co-develop battery-swap & fast-charge corridors with energy majors to reduce “range anxiety” for city commuters.

5️⃣ 𝗙𝘂𝘁𝘂𝗿𝗲-𝗽𝗿𝗼𝗼𝗳 𝘄𝗶𝘁𝗵 𝗽𝗼𝗹𝗶𝗰𝘆 𝗶𝗻𝘁𝗲𝗹𝗹𝗶𝗴𝗲𝗻𝗰𝗲

💡 Monitor GST, CAFÉ III, and six-airbag timelines; bake regulatory costs into 24-month pricing roadmaps rather than resorting to last-minute hikes.

📊 𝙎𝙩𝙧𝙖𝙩𝙚𝙜𝙞𝙘 𝙩𝙖𝙠𝙚𝙖𝙬𝙖𝙮: 𝘋𝘪𝘷𝘦𝘳𝘴𝘪𝘧𝘺 𝘱𝘰𝘸𝘦𝘳𝘵𝘳𝘢𝘪𝘯𝘴, 𝘱𝘳𝘪𝘤𝘦 𝘱𝘰𝘪𝘯𝘵𝘴, 𝘢𝘯𝘥 𝘨𝘦𝘰𝘨𝘳𝘢𝘱𝘩𝘪𝘦𝘴 𝘯𝘰𝘸—𝘰𝘳 𝘳𝘪𝘴𝘬 𝘤𝘩𝘢𝘴𝘪𝘯𝘨 𝘢 𝘴𝘩𝘳𝘪𝘯𝘬𝘪𝘯𝘨 𝘴𝘭𝘪𝘤𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘮𝘢𝘳𝘬𝘦𝘵 𝘱𝘪𝘦.

🔍 Which of these pivots do you think will create the biggest competitive edge in FY 26 and beyond? Share your views!