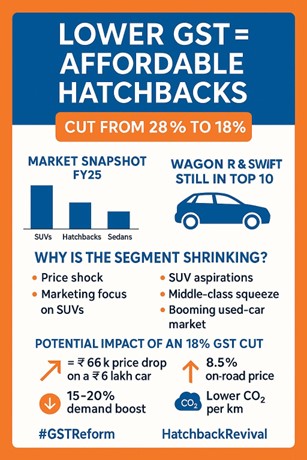

Hatchbacks remain the gateway to personal mobility, yet their market share slid to 23.4 % of FY-25 passenger-vehicle sales—its fifth straight yearly fall

📊 𝗕𝘂𝘁 𝘄𝗮𝗶𝘁—𝗪𝗮𝗴𝗼𝗻 𝗥 & 𝗦𝘄𝗶𝗳𝘁 𝗮𝗿𝗲 𝘀𝘁𝗶𝗹𝗹 𝗯𝗲𝘀𝘁-𝘀𝗲𝗹𝗹𝗲𝗿𝘀

➡️ Maruti Wagon R kept its No. 1 crown with 1.98 lakh units, while the Maruti Swift stayed in the FY-25 top-10

➡️ So why is the segment shrinking even with these star performers?

𝗪𝗵𝗮𝘁’𝘀 𝗿𝗲𝗮𝗹𝗹𝘆 𝗵𝗼𝗹𝗱𝗶𝗻𝗴 𝗵𝗮𝘁𝗰𝗵𝗯𝗮𝗰𝗸𝘀 𝗯𝗮𝗰𝗸?

1️⃣ Price shock – Safety-airbag & emission upgrades have inflated sticker prices 30–40 % in just 5–6 years

2️⃣ SUV aspiration gap – Sub-4 m SUVs such as the Tata Punch or Hyundai Exter start barely ₹30-50k higher, but offer ground-clearance, style and tech that buyers crave

3️⃣ OEM focus & marketing – Five of FY-25’s top-10 cars were SUVs; launch calendars, ad spends and dealer incentives now chase fatter SUV margins

4️⃣ Middle-class squeeze – Compact-car volumes fell 13 % YoY to ~1 mn, while SUV sales jumped 10 %

5️⃣ Booming used-car market – A 3-yr-old compact SUV now costs what a brand-new base hatchback does, siphoning away value-hunters

💡 𝗜𝗺𝗽𝗮𝗰𝘁 𝗼𝗳 𝗰𝘂𝘁𝘁𝗶𝗻𝗴 𝗚𝗦𝗧 𝘁𝗼 𝟭𝟴 %

➡️ A ₹6 lakh hatchback would be ~₹66,000 cheaper, slicing on-road prices ~8.5 %.

➡️ Every 10 % drop in entry price can unlock 15-20 % latent demand, reviving idle capacity and Tier-2/3 dealer jobs.

➡️ Hatchbacks emit less CO₂/km than SUVs, helping India meet CAFÉ targets more affordably.

➡️ Higher volumes strengthen local supply chains—engines, airbags, electronics, tyres—boosting Make-in-India benefits.

🏛️ 𝗣𝗼𝗹𝗶𝗰𝘆 𝘀𝘂𝗴𝗴𝗲𝘀𝘁𝗶𝗼𝗻

𝙎𝙝𝙞𝙛𝙩 𝙨𝙪𝙗-4 𝙢 𝙥𝙚𝙩𝙧𝙤𝙡 & 𝙙𝙞𝙚𝙨𝙚𝙡 𝙝𝙖𝙩𝙘𝙝𝙗𝙖𝙘𝙠𝙨 (≤ 1,200 𝙘𝙘 / ≤ 1,500 𝙘𝙘) 𝙩𝙤 𝙩𝙝𝙚 18 % 𝙂𝙎𝙏 𝙨𝙡𝙖𝙗 𝙖𝙣𝙙 𝙨𝙘𝙧𝙖𝙥 𝙩𝙝𝙚 1-3 % 𝙘𝙚𝙨𝙨.

This single tweak can:

1️⃣ Restore affordability for first-time buyers & gig-economy drivers.

2️⃣ Protect the ~100k shop-floor jobs the segment still sustains.

3️⃣ Offer OEMs a cost-neutral path to CAFÉ compliance without subsidies.

If EVs deserved a 5 % GST in 2019, mass-market hatchbacks surely warrant an 18 % rate today.

Let’s make mobility affordable again!

💬 𝘞𝘰𝘶𝘭𝘥 𝘢 𝘭𝘰𝘸𝘦𝘳 𝘎𝘚𝘛 𝘳𝘦𝘷𝘪𝘷𝘦 𝘐𝘯𝘥𝘪𝘢’𝘴 𝘴𝘮𝘢𝘭𝘭-𝘤𝘢𝘳 𝘴𝘵𝘰𝘳𝘺? 𝘋𝘳𝘰𝘱 𝘺𝘰𝘶𝘳 𝘵𝘩𝘰𝘶𝘨𝘩𝘵𝘴, 𝘵𝘢𝘨 𝘢 𝘱𝘰𝘭𝘪𝘤𝘺𝘮𝘢𝘬𝘦𝘳, 𝘢𝘯𝘥 𝘬𝘦𝘦𝘱 𝘵𝘩𝘦 𝘤𝘰𝘯𝘷𝘦𝘳𝘴𝘢𝘵𝘪𝘰𝘯 𝘳𝘰𝘭𝘭𝘪𝘯𝘨.