Over the past five years, Indian investors have watched corner‑office shake‑ups with a mix of excitement and skepticism. Here’s what the numbers—and the standout cases—really say 👇

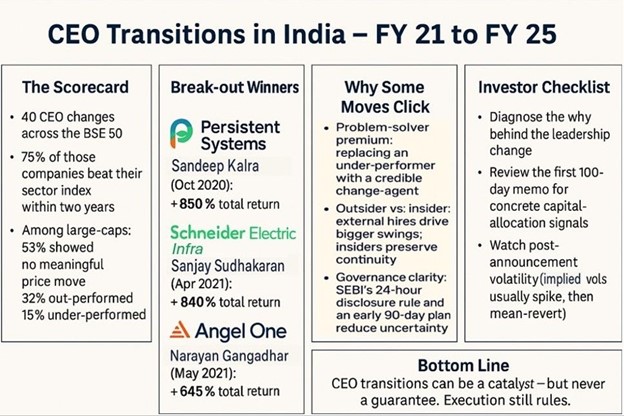

🏁 𝑻𝒉𝒆 𝒔𝒄𝒐𝒓𝒆𝒄𝒂𝒓𝒅 (𝑭𝒀 21 – 𝑭𝒀 25)

➡️ 40 CEO changes across the BSE 500.

➡️ 75 % “hit‑rate” – 30 of those companies beat their sector index within two years of the hand‑off.

➡️ Large‑caps are harder to impress: a Jefferies study covering 72 Nifty‑universe successions found 53 % neutral, 32 % positive, 15 % negative price reactions.

🌟 𝑩𝒓𝒆𝒂𝒌‑𝒐𝒖𝒕 𝒘𝒊𝒏𝒏𝒆𝒓𝒔

1️⃣ Persistent Systems – Sandeep Kalra (Oct 2020) ➡️ ~+850 % total return.

2️⃣ Schneider Electric Infra – Sanjay Sudhakaran (Apr 2021) ➡️ ~+840 %.

3️⃣ Angel One – Narayan Gangadhar (May 2021) ➡️ ~+645 %.

Returns measured up to 19 July 2025

⚠️ 𝑩𝒊𝒈‑𝒄𝒂𝒑 𝒓𝒆𝒂𝒍𝒊𝒕𝒚 𝒄𝒉𝒆𝒄𝒌

➡️ Tech Mahindra popped ~8.5 % intraday when Mohit Joshi was named CEO (Mar 2023), but the longer‑term rerating now depends on delivery, not headlines.

🔍 𝑾𝒉𝒚 𝒔𝒐𝒎𝒆 𝒎𝒐𝒗𝒆𝒔 𝒄𝒍𝒊𝒄𝒌

➡️ Problem‑solver premium – ousting an under‑performer and hiring a credible change‑agent tends to unlock upside.

➡️ Outsider vs insider – external hires create larger swings; insiders preserve continuity but seldom spark re‑rating.

➡️ Governance clarity – SEBI’s 24‑hour disclosure rule shrinks rumour windows; firms that publish a 90‑day plan early observe lower volatility.

🛠️ 𝑰𝒏𝒗𝒆𝒔𝒕𝒐𝒓 𝒄𝒉𝒆𝒄𝒌𝒍𝒊𝒔𝒕

➡️ Diagnose the why behind the change.

➡️ Read the first‑100‑day memo for capital‑allocation signals, not buzzwords.

➡️ Watch volatility: post‑announcement implied vols usually spike and then mean‑revert.

➡️ Track FPI/MF flows during the first three months for conviction signals.

🔮 𝗕𝗼𝘁𝘁𝗼𝗺 𝗹𝗶𝗻𝗲: A CEO change can be a powerful catalyst, but only if it fixes a recognised strategic gap and the new leader earns trust fast. Execution still rules.

💬 Agree? Disagree? Drop your succession stories below!